Battery Replacement

Car batteries only last between 3 to 5 years. However, extreme weather, frequent short trips and heavy use of electronics can significantly reduce their lifespan. Modern cars need specialized batteries that are much more expensive than traditional ones. A sudden battery failure can leave you stranded and may even require an emergency replacement - which can cost thousands. Hybrid and electric vehicles have even higher battery costs, though they don't need replacing quite as frequently. Many drivers forget to budget for this expense, which can result in significant financial strain.

Car Insurance

Car insurance is mandatory in most parts of the world, but prices can vary greatly based on age, driving record and where you live. Many people don't actually realize just how much insurance increases after an accident or claim. Even minor fender-benders can double your monthly payment. Roadside assistance and comprehensive coverage also drive up costs. Comparing options can help, but companies usually raise their rates on a yearly basis. Over time, insurance may even become one of your biggest ongoing vehicle expenses.

Licence Renewals

Many new drivers don't realize that licence renewal is an ongoing requirement that costs money every time. While the fee initially seems small, missing deadlines can lead to penalties, fines or even suspension - all of which add to the overall cost. In some areas, renewal even requires eye tests or medical checks, which also add extra expenses. Moving to a new state or country usually means that you'll have to pay for new documents entirely. If you forget to budget for such things, the expenses can add up quickly - especially if finances are already tight.

Registration & On-The-Road Fees

When buying a car, registration and "on-the-road" fees are usually hidden within complicated contracts and paperwork. These fees include administrative costs, plate fees, as well as dealer handling charges. They may seem small in comparison to the actual price of the car, but they can end up adding hundreds or even thousands to your total bill. Some dealerships even combine vague charges, such as delivery or processing fees without any sort of clear explanation. Over the years, re-registration or plate renewals also add ongoing costs that many owners overlook completely.

Fuel Price Fluctuations

Fuel is the most obvious ongoing vehicle expense, but it is also very tricky to budget for. Global oil prices, taxes and local supply issues often fluctuate, causing sudden spikes and drops. As a result, a budget planned around stable fuel costs can collapse when prices rise overnight. Long commutes or road trips also increase the impact. Even switching to premium fuel for better performance or following manufacturer recommendations raises costs. Hybrid or electric cars lessen fuel dependency, but charging stations and electricity rates are also pretty pricey. Overall, fuel remains a volatile and unavoidable expense for any driver.

Maintenance & Servicing

Routine maintenance keeps your car running smoothly for as long as possible. Skipping frequent servicing can lead to bigger and more expensive repairs down the line. While service intervals vary by manufacturer, most cars need check-ups every 10 000 to 15 000 km. Costs also rise if you use authorized dealerships instead of independent mechanics. Unexpected issues, such as timing belt replacements or coolant leaks, can cost a fortune to replace, only adding to the financial burden. Many owners underestimate just how often these services are needed, which can result in an unpleasant surprise if finances are already tight.

Tyres

Tyres wear out faster than most drivers expect - especially in bad road conditions or when driving fast. Replacing a full set can cost thousands and premium brands are even more expensive. Rotations, balancing and alignments only add to these costs. More so, ignoring tyre maintenance lowers fuel efficiency and raises the risk of accidents, making this service essential. In seasonal climates, you may also need winter or performance tyres, which can double your expenses. Cheap tyres may seem like a good deal, but they also wear out more quickly, leading to frequent replacements. Tyres are an often-overlooked but important expense that directly impacts safety, performance and long-term costs for your car.

Parking Fees

If you live or work in a city, chances are you will have to pay a small fortune every month in parking fees. Daily fees, monthly permits and residential parking passes add up fast. Even trips to malls or airports can be expensive. In urban areas, safe parking sometimes costs more than gas! More so, fines for expired meters or parking in restricted zones add up quickly. For people living in apartments, renting a garage or parking space becomes a regular expense.

Tolls

Highway tolls may save time (and therefore money on fuel), but they also cost money. Frequent commuters can spend thousands every year on tolls - especially in areas with many toll roads. Electronic toll systems make payments easy, but they only reveal the total expense when monthly statements come in. People who travel occasionally might not notice, but for daily users, tolls are a major expense. Some cities even charge extra fees for entering busy areas. While tolls help to improve road infrastructure, they are an ongoing cost that many drivers forget to budget for.

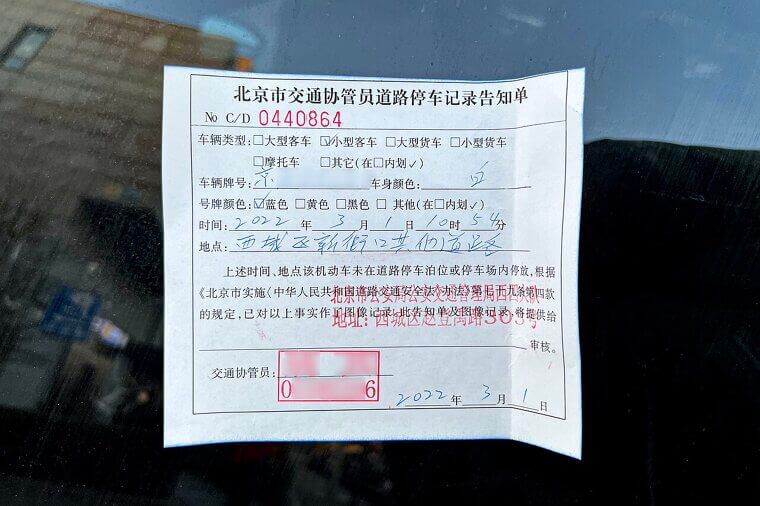

Fines & Penalties

Speeding tickets, parking fines and expired license penalties are hard to predict. Minor infractions can cost hundreds and repeated offenses often result in hefty fines that add up quickly. After traffic violations, insurance premiums also increase, adding to the total expense. In some areas, points are added to your license, which can result in mandatory suspensions. Although these fines can be avoided, they are a hidden cost because they come unexpectedly. People make mistakes and, in many cases, they forget to budget for these errors.

Car Wash & Detailing

Keeping your car clean isn’t just about looks. It protects the paint, prevents rust and helps to maintain its overall resale value. Regular washing, waxing and detailing may be expensive, but it is also necessary. In fact, professional detailing can cost hundreds. Washing it yourself saves money but it also takes time - something that many people just don't have. If you neglect this chore, the resale value of your car will slowly deteriorate over time. Many owners don't realize just how often their car will need to be professionally cleaned, meaning that they don't budget for it either.

Depreciation

Depreciation is actually the biggest expense of owning a vehicle. Most owners won't be able to sell their second-hand vehicle for anywhere near as much as they bought it for new, leading to a massive overall loss. In fact, a car loses about 50% of its total value in just 5 years. While depreciation isn't a cash expense, it does impact resale and trade-in value, leading to a bigger financial loss in the long run.

Extended Warranties

Dealers often promote extended warranties for additional security. However, while these warranties may seem like a good idea initially, many duplicate manufacturer coverage or do not cover the most common problems. Costs can reach thousands upfront or be financed - which makes for an even bigger loss in the long run. Although extended warranties can assist with infrequent major repairs, they are usually unnecessary for new and dependable cars. Because minor issues aren't covered a lot of the time, drivers end up having to pay extra for repairs anyway.

Interest on Financing

Car loans are often the only way in which people can afford to buy a car, but they also come with additional costs. Even low rates add up in the long run. For example, a car that initially cost around $20 000 can end up costing closer to $25 000. Longer loan terms may lower monthly payments, but they also increase the total cost. Many buyers see only consider the monthly cost, which can seem quite reasonable. However, over the span of a few years, these monthly installments add up to a massive amount. Refinancing or making extra payments on the principal can lower interest, but most drivers just stick with standard terms.

Accessories & Add-Ons

While certain add-ons may seem small, they add up quickly in cost. Dealers often promote accessories when you buy a car and include them in the financing. Aftermarket upgrades, such as tinted windows, spoilers or custom wheels, can cost even more. While some add-ons do improve comfort or resale value, many are just unnecessary luxuries that cost a small fortune.