These Factors Affect the Rate You Get for Your Car Insurance

Car insurance rates can seem like they’re calculated by a wizard in an office somewhere. But there’s no magic here, just math (and a few surprises). From your driving record to your ZIP code, lots of things can bump up or down that premium. Here are 10 big ones you should know.

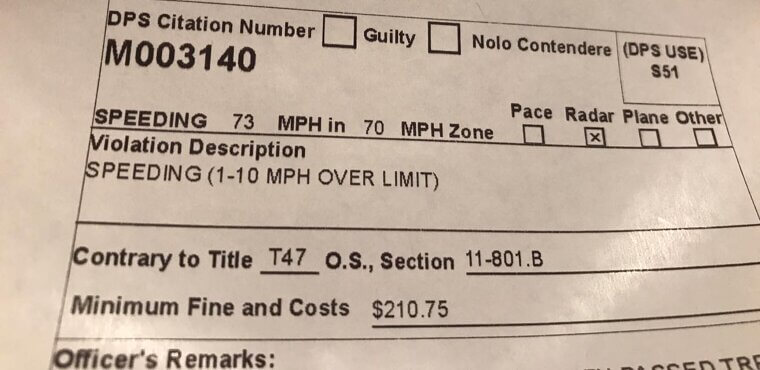

Driving Record

Your driving record is like your report card; tickets, accidents, and DUIs are all big red flags. A clean record means you’re low risk and usually means lower premiums. But pile up the violations, and you’ll see your rates soar faster than a new sports car on a highway.

Age

Insurance companies know younger drivers (especially teenagers) are prone to take more risks. That’s the reason they tend to pay more. As you age (and presumably get wiser), your rates should decrease. However, don’t get carried away; drivers over a certain age may see rates go up again due to slower reaction times.

Location

Your ZIP code can tell a lot about your risk. High-crime areas, or areas with more accidents, get higher rates. Live in a rural area where there are fewer cars and lower theft rates? You might get cheaper insurance and fewer traffic jams to ruin your day.

Vehicle Type

That convertible looks good, but it may make your insurance premium look bad. Cars that cost more to repair, are stolen often, or can go fast, will usually cost more to insure. Minivans and sedans? Usually more cost-efficient.

Mileage

The more you drive, the more likely you are to have an accident. This is why high-mileage drivers pay more. Conversely, if you work from home and hardly use your car, you may be able to get a lower rate.

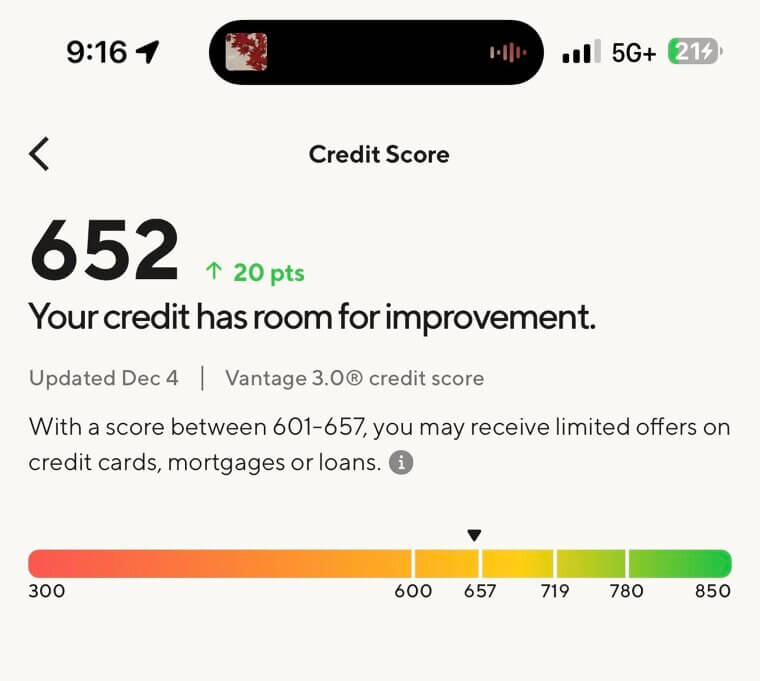

Credit Score

In many states, insurers utilize your credit score as part of the rate calculation process. A good score means you are responsible, and insurers like that. Regardless of whether you ever got a ticket, your money habits can alter the cost of your driving.

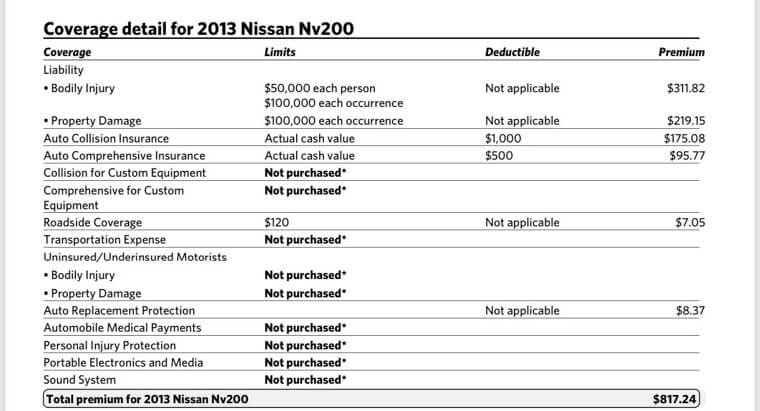

Coverage Level

More coverage means more protection, but it will also mean you're paying for more. The minimum coverage is less expensive, but you’ll pay more out of pocket in a crash. Full coverage with extras will cost you upfront, but could save you a ton of money if things go sideways.

Claims History

If you've made several insurance claims, you may be considered a higher risk. Even small claims can add up and make you look worse in the eyes of the insurer. Staying claim-free for a while can help lower your rates. This also prevents you from getting a "high-risk" label.

Gender

Though it may seem unfair, statistics show that men, especially younger men, are more likely to be involved in serious accidents. As a result, men often have to pay more for insurance than women who are the same age. Thankfully, the gap generally decreases as drivers age and become safer.

Discounts and Perks

Safe driver discounts, bundling policies, and anti-theft devices can all help to reduce your bill. Insurance companies like to reward low-risk customers, so take advantage of all available perks. Sometimes, just asking your insurer about discounts can shave dollars off your premium.