Automakers Don't Want You to Know About These Hidden Maintenance Costs

A car - or any vehicle for that matter - is no small investment. It costs a lot of money upfront, and even more than you may expect, even after your purchase. It’s more than just fuel - and the wise budgeter will pay careful attention to these hidden costs that automakers and dealers aren’t always “upfront” about.

Depreciation

Depreciation isn’t so much a maintenance cost as it is money-sink. Simply put, as most of you will no doubt be aware, cars lose their value over time. Some vehicles are more susceptible to the effects of depreciation than others, losing up to 60% of their value over just 5 years - but, of course, you won’t find any of that in the small print!

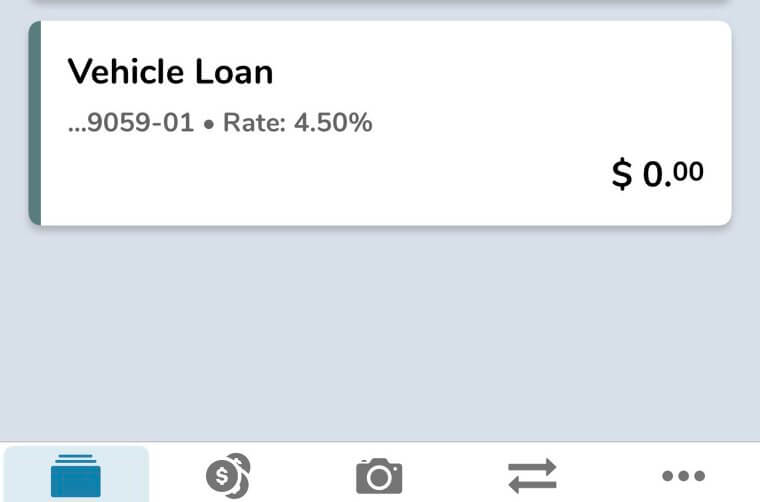

Financing Interest

Buying a car - or any vehicle for that matter - is no small financial feat, and many drivers will inevitably have to take out a loan or apply for financing in order to afford their daily commuter. Unfortunately, these agreements often come with steep interest rates, which can easily be lost during the sales pitch.

Loan Balloon Payments

If it’s a loan you’re after, make sure you keep the balloon payment in mind. This is a lump sum of money that you will have to pay at the end of your loan term. Like financing interest rates, it’s easy to forget about this, so it’s imperative that you work this into your budget before agreeing to your contract.

Vehicle Registration

You’d think buying and subsequently owning a car would be easy - pay for the vehicle and you’re all set, right? Unfortunately, when you become the owner of a vehicle, you’ll have to get it registered in your name, too. And not just once, either - depending on your region, you could end up paying for a registration fee every year!

Purchase Fees

What, you thought the number on the price tag was all you had to pay? Sales taxes are sort of like transaction fees that you would pay for using an ATM. They’re a once-off, luckily, but they’re often not included upfront, only taking effect once they’ve been added to your finance agreement.

Insurance Premiums

Insurance is one of those things that you hope to never make use of, but should the worst come to pass, you’ll be glad to have it. Unfortunately, it can be difficult to gauge exactly how much you’ll be paying for your car insurance, since rates tend to vary based on make, model, brand, and even your own driver profile.

Insurance Excess

Depending on how much coverage you apply for, you may end up having to pay excess fees when you file a claim. These are out-of-pocket deductible charges, but they’re easy to forget about until you actually need to make use of your insurance.

Fuel Costs

Hopefully this isn’t news for you, but if you plan on purchasing a traditional gas-powered vehicle, you’re going to have to pay for… well, gas. Of course, the exact amount you’ll need to pay for will vary based on the vehicle you purchase - a value salesmen and automakers tend to low-ball.

Oil Costs

Like fuel - be it gasoline, diesel, or otherwise - oil is an essential component to keep your vehicle running smoothly, essentially helping to maintain your engine. Different cars require different types of oil; however, some of which are more expensive than others.

Routine Maintenance

Many drivers often overlook the importance of routine maintenance checks - inspections, filter changes, that sort of thing. The cost of these checks, however, will vary depending on your vehicle, a detail that may go unspoken when you make your purchase.

Wear-And-Tear Consumables

Part of these routine maintenance checks involves the inspection of certain components essential for keeping your vehicle running as it should. Brake pads, tires, and even wipers - all these things are prone to wear and tear and will inevitably need to be replaced. Again, as with most hidden costs, the exact amount you’ll end up paying will depend on the vehicle you drive.

Out-Of-Warranty Repairs

Depending on where you get your vehicle, it may come with a warranty that should cover you for any issues you encounter. If you’re buying second-hand, however, there’s a good chance you’ll need to pay for any repairs out of your own pocket - and they’re not exactly cheap.

Tire Replacements (and Rotations)

Aside from getting your tires pumped regularly, there’s a good chance that you’ll need to replace them every so often, too. At the very least, they’ll need to be rotated to ensure even wear across each tire, whose exact cost will vary depending on the make and brand.

Wheel Alignment

Your car’s wheels are affixed to an axle, a component that has a tendency to get all bent out of shape the longer you drive. This necessitates having to get your wheels realigned from time to time, which can be costly.

Battery Replacement

Your car’s battery is responsible for keeping it, well, alive, for lack of a better word. But like any vital car component, it won’t last forever, and you will inevitably need to have yours replaced every few years or so, something that isn’t always immediately obvious when you first make your purchase.

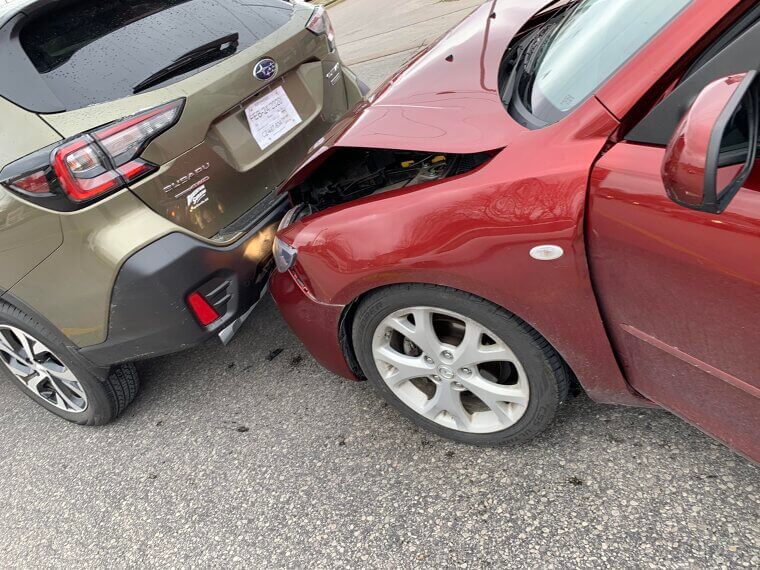

Brake and Transmission Repairs

Your car’s transmission is responsible for changing it from one gear to another - your car’s brakes are responsible for preventing you from crashing. Needless to say, they’re both important components, components that will need to be inspected and repaired every once in a while.

Electronic and Dashboard Issues

These days, car dashboards are filled with all sorts of technological gizmos all designed to “enhance” your driving experience. They’re often pitched as something that you absolutely must have, but in truth, the more complicated these systems get, the more expensive they become to repair - a fact that your salesman may conveniently gloss over.

Roadside Assistance

It’s many anxious drivers’ worst nightmare to break down unexpectedly on the side of the road. It happens to everyone, but if and when you find yourself in this situation, you may need to pay for a standalone service out of your own pocket.

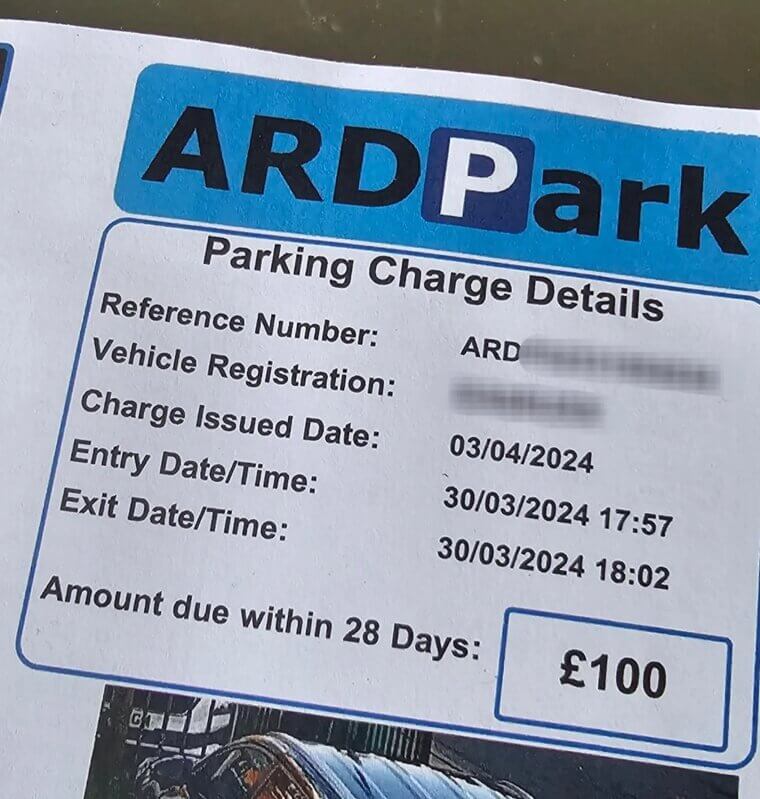

Parking

As if all of this wasn’t enough already, there are still costs involved even when your car is perfectly stationary and immobile. Indeed, parking fees may seem like small costs, but they add up greatly over time.

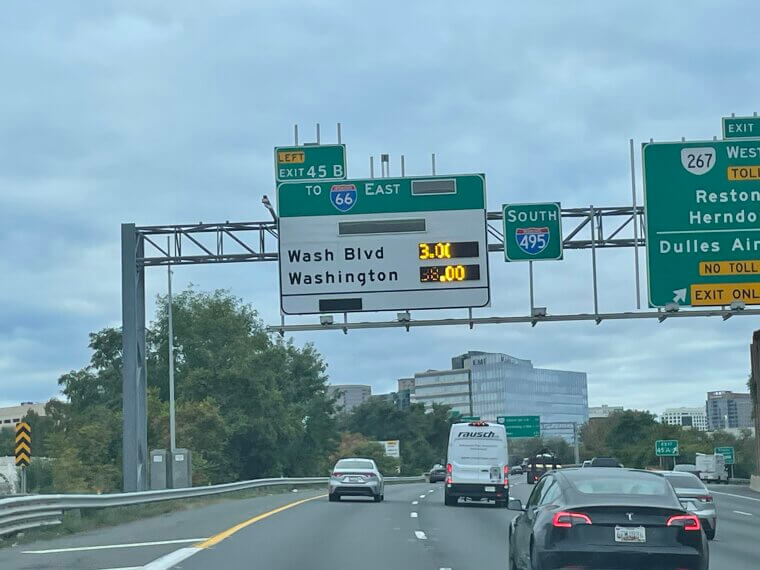

Tolls

Like parking fees, toll fees usually aren’t too unreasonable - (of course, this depends entirely on where you’re going) - but they can cut deeply into your budget, especially if you travel frequently.

Security Devices

Insurance is one thing, but real vehicle security is another. Many drivers nowadays have trackers and other security devices installed in or on their vehicles. Of course, many of these fall outside of the initial cost, forcing you to pay extra for some added peace of mind.

Car Washes

Of course, your car can be in perfect order on a mechanical level, perfectly functional and safe to drive. But, let’s face it, none of that matters if your car is absolutely filthy. Professional cleaning services are usually reasonably priced, but it’s still something that you should budget for in advance.

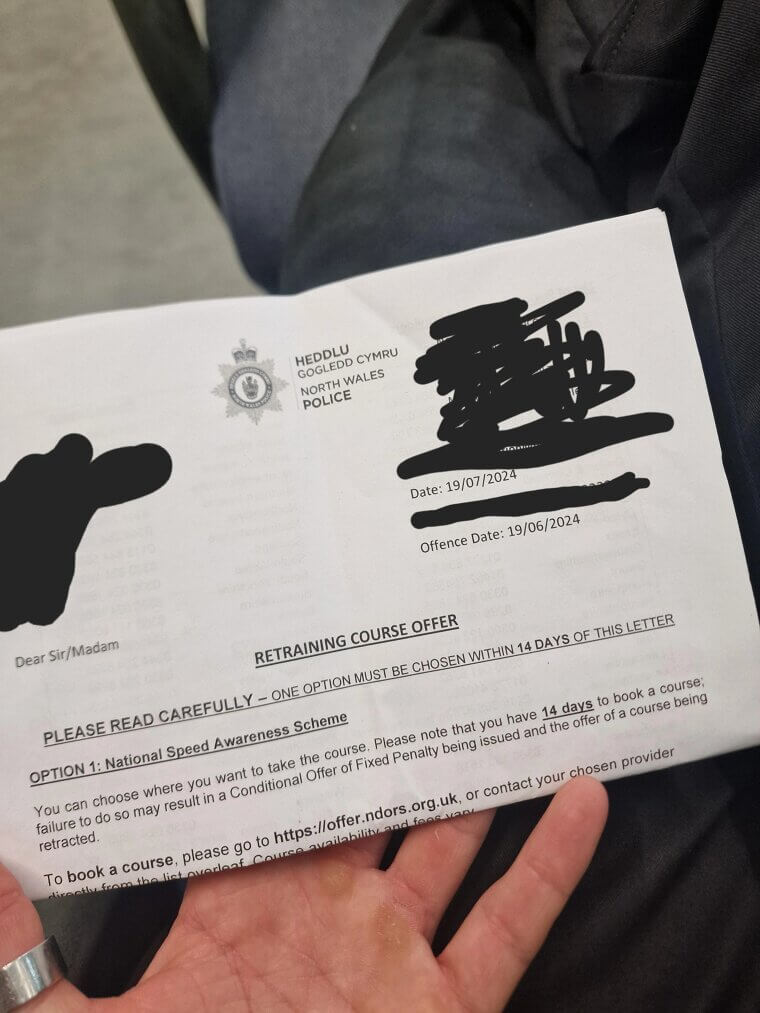

Fines and Penalties

We know - you could have sworn that the light was green when you went careening down the road. Like it or not, you’re going to make some mistakes while driving at some point or another, and these mistakes will cost you a fair bit.

Road and Emissions Inspections (MOT)

Somewhere between your routine maintenance checks, your vehicle will probably also be subject to Road and Emissions Inspections. These are checks that seek to ascertain whether your vehicle is safe to drive and whether it meets environmental standards.

Dash Cams and Other Accessories

In a similar vein to security devices and trackers, you may also want to invest in a dash cam and other accessories. These aren’t exactly necessary purchases, but many drivers end up paying for them regardless.

Home Modifications

Your vehicle and your property are two separate entities - so why is this included here? Well, your car needs a place to sleep when it’s not in use, and so you may end up having to pay for garage repairs or the installation of a door or gate. They’re what you might call indirect costs.

Loan Interest Rate Increases

Going back to loans for a second, the type of loan you apply for also determines how much you’ll end up paying. This shouldn’t be news to anyone, but it is worth keeping in mind that variable interest loans can be particularly finicky to deal with.

Add-Ons and Optional Features

A car is an investment; like a house, it’s something you’ll pay a lot of money for, and therefore may want to really “make it your own”. Optional features and add-ons are one way to do this - leather seats, sound systems, and the like. Of course, they don’t come free!

Accessory Depreciation

We mentioned depreciation earlier, referring to the value cars lose passively over time. What you may not realize, however, is that certain modifications can also negatively affect your resale value.

Luxury and EV Depreciation

While we’re on the topic of depreciation again, it’s worth noting that electric vehicles and luxury models are particularly susceptible to steep depreciation curves. They also cost more to repair and insure, by the way.

Charging Costs

If you do end up going the EV route, keep in mind that in the same way that you’d need to pay for gas for traditionally powered vehicles, you’ll have to pay for your vehicle to be charged, too. You may also need to invest in a home-charging setup, which can be pretty pricey upfront.

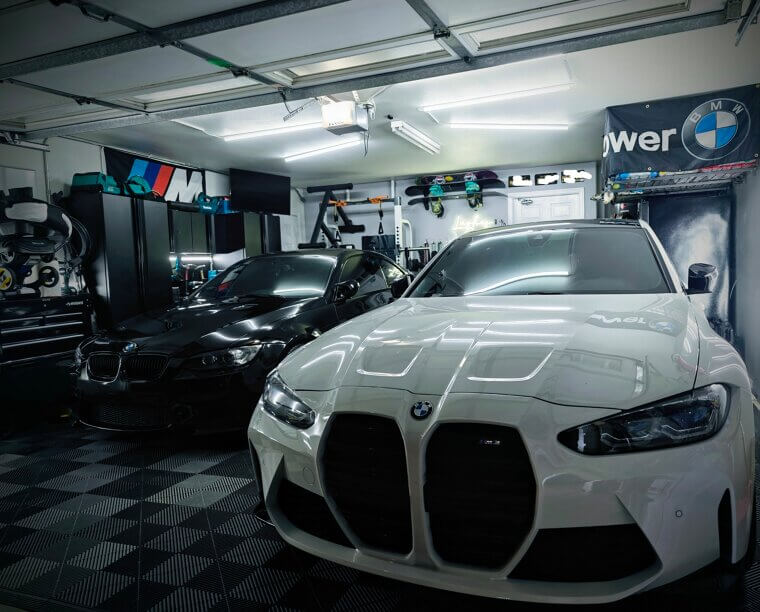

European Costs

Believe it or not, owning a fancy European-made car can actually be a pretty big financial detriment. These brands - like BMW and Porsche - charge more for their dealer services - and their parts are way more expensive, too.

Older Model Costs

In a similar vein to European cars, older cars in general tend to incur much higher maintenance fees, typically due to the scarcity of parts or simply due to their more demanding and more frequent repairs.

Dealership Fees

As if it weren’t enough that you had to pay a purchase fee, some dealerships also charge on-the-road service fees - things like valets and administrative services - which can often go overlooked.

Inflation

Finally, the last “hidden” car ownership cost is none other than that age-old economic killer: inflation. You can’t blame the automakers for not outlining this one - no one knows what the state of the economy will be like next month, but you can bet that inflation can and will affect everything you pay for, and not just for your car either.