Automatic Renewal

Your insurance is only good for a fixed period before it needs to be renewed. This is typically done on a yearly basis, at which point it’s often prudent to shop around for alternative coverage, especially if your premiums have gone up. Unfortunately, many older drivers value stability over anything else, meaning many of them end up paying far more for simple car insurance than they would have if they had shopped around.

Not Updating Annual Mileage

A younger person may spend a significant amount of their day driving from one place to another, whether it’s to school, university, or work. This necessitates a high mileage listing on their car insurance, which older drivers would do well to avoid, especially if they spend most of their time at home.

Unneeded Coverage

Insurance packages are designed to be as appealing as possible; you’ll often see car coverage advertised in a package with additional add-ons, like roadside club duplication or rental reimbursement, all in the name of “value”. As an older driver, however, it’s unlikely you’ll ever make use of these add-ons, rendering them a useless waste of money.

Named Drivers

When you apply for car insurance, you will need to declare a main driver for the vehicle you want to insure. It’s important that you ensure this is truthful, since keeping an older named driver on can actually increase your premiums. Conversely, listing a younger driver can sometimes lower your premiums, but it’s important that you don’t put yourself at risk of fronting.

Overlooking Discounts

Sometimes saving money as an older driver is as simple as looking for a good discount. These aren’t always available, but adult driver, defensive driving, and low-mileage discounts can often be claimed after a little bit of digging and shopping around, saving you a whole lot in the long run.

“Limited Coverage”

Many drivers, not just older ones, will often find themselves falling for the simplest trick in the book: not reading the fine print. For car insurance, this often means assuming that limited coverage actually covers the basics, but it doesn’t extend to uninsured drivers, medical bills, and your own vehicle.

Medical Coverage

Many older drivers make the mistake of relying solely on Medicare for their medical coverage. In fact, MedPay often covers things like deductibles, co-pays, and even some non-covered items at a typically lower rate. Again, it’s always worth keeping your options wide open.

High Deductibles

Finding the right deductibles amount is a tricky balancing act. While opting for higher deductibles may lower your premiums, you may regret your choice in the event of an accident, especially if you’re working off of a single fixed income.

Medical Conditions

Many older drivers make the mistake of downplaying any medical conditions they may have. These range from more generalized issues like poor eyesight to downright debilitating conditions like mobility issues. It’s important that you declare these accurately and honestly when you sign up for coverage - it may increase your premiums, but it’ll also decrease your chances of having a claim denied in the event of an accident.

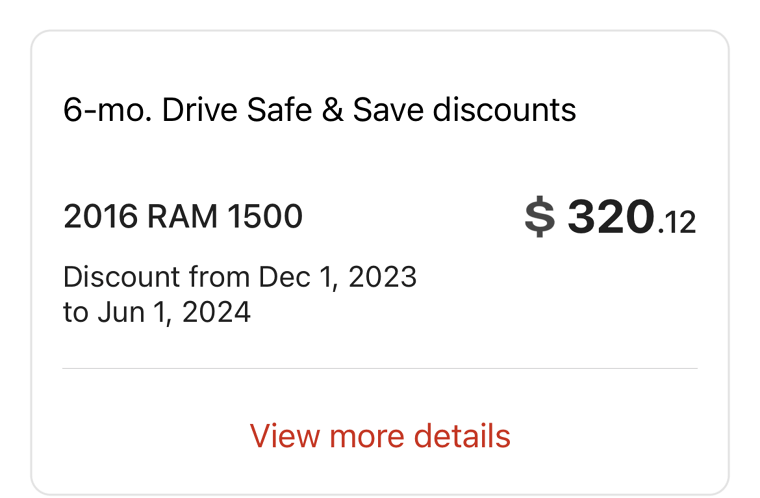

Telematics-Based Policies

If you’re an older driver who only occasionally makes use of their vehicle for short trips, it’s absolutely worth it to look into getting a telematics-based policy. These are often far cheaper than traditional policies, offering major discounts for experienced, careful drivers. Unfortunately, not many older drivers take advantage of them due to low awareness of their existence.

Senior Discounts

Many older drivers rely on senior discounts to be able to afford their insurance premiums for every period of coverage. What some of these drivers don’t understand, however, is that these senior discounts are not automatically granted - you need to apply and qualify for them separately.

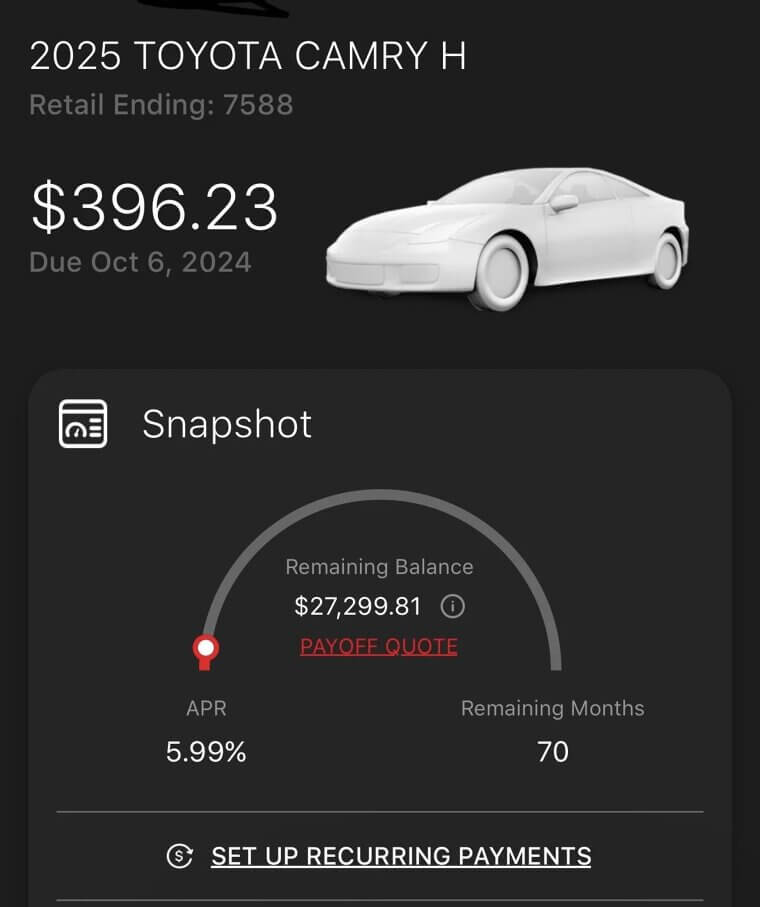

Collision Coverage

Collision coverage is definitely an important piece of your car insurance policy, especially if you’re driving a fairly modern vehicle (released in the past two decades). For older cars, however, your collision coverage premiums can often exceed the actual value of the vehicle, so keeping the coverage probably won’t make a whole lot of sense, financially speaking.

Roadside Assistance Overlaps

Having the option to receive roadside assistance is a great benefit for any driver, not just older ones. What you may not realize, however, is that you don’t necessarily need to receive it via your insurance - it’s entirely possible that you already have a roadside assistance policy with your manufacturer or AAA.

Updating Your Address

Your insurance premiums are based on a wide variety of factors that you play a part in determining. That’s why ensuring that all the information you provide is accurate is so important. For example, many older drivers make the mistake of not updating their residential address. Especially if they move to a rural or low-risk neighborhood, this is often enough to get their premiums decreased.

First Quote

When you’re in an accident and need to make a claim, don’t accept the first quote the adjusters give you. They will often underestimate the extent of the damages (and thus, the cost of the repairs), leaving you unable to actually repair your vehicle. Some good old fashioned negotiation is key here.

Policy Documents

Policy documents are the legally binding documents that confirm your car insurance. They include details about your coverage, from the insurer to the actual items being insured, as well as add-ons, benefits, and deductibles. However, your insurance will likely change from one year to the next, and if you don’t read your policy documents thoroughly, you may be left stranded in the event of a claim.

Monthly Installments

Brokers and insurers will do anything to make an extra buck, including charging you monthly administrative fees. These can leave your wallet feeling parched, especially if you’re on a fixed income. For older drivers, it’s almost always cheaper to settle for an annual lump sum.

Umbrella Policies

Umbrella policies lump together both home and car insurance policies in a single package. These are typically more affordable than if you were to pay for separate car and home insurance policies, and while we encourage you to look into them as an older driver, keep in mind that they also have a much harsher risk gap.

Technology Repair Costs

Many modern cars nowadays feature an array of sensors and cameras, both of which are extremely weak to even the most minor bumps. Unfortunately, your car insurance won’t cover these by default, meaning you’ll need to pay for them out-of-pocket for repairs.

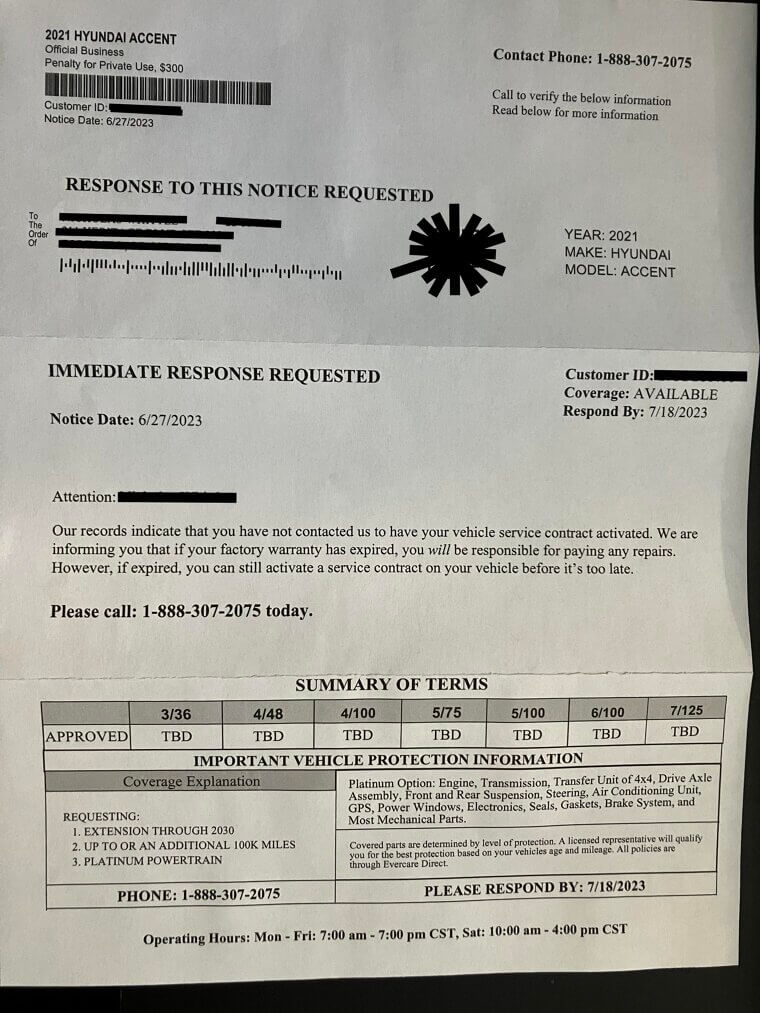

Too Good To Be True

When all is said and done, the main trap that older drivers (and many younger drivers, too) still fall into nowadays are those “too good to be true” phone offers. Scammers and con-men will often offer totally unrealistic insurance coverage that doesn’t actually meet legal requirements, leaving you completely stranded and much poorer for it, too.