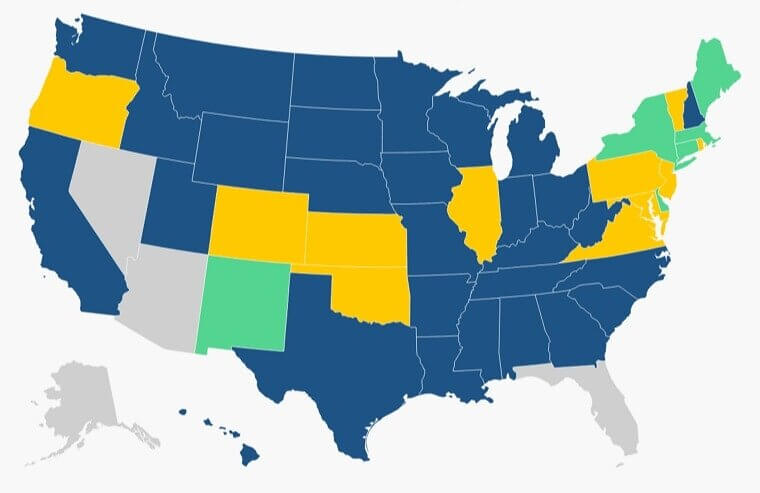

Here's What Each State Charges as EV Tax

For years, gas taxes were used to repair roads and fill potholes. Now, as drivers leave the pump for the plug, states are figuring out how to recoup gas-related taxes from EVs. From generous credits to head-scratching fees, these are how states are taxing and rewarding EV ownership.

Alabama

Thinking of going electric in Alabama? Better budget for it. The state adds a $203 annual fee for EVs and $103 for plug-in hybrids. There are no purchase credits to help ease the pain, so owning an EV here feels like paying dues rather than saving green.

Alaska

Alaska hasn’t yet jumped on the EV fee bandwagon. No extra registration charges or incentives. It’s kind of a neutral zone: you won’t get dinged for driving electric, but you won’t get much help buying one either.

Arizona

Arizona is surprisingly light on EV drivers. It has no special registration fee and no big state purchase credit to brag about either. The state is hands off, so you’ll have to lean on federal credits or utility perks instead. At least there’s no extra bill to pay.

Arkansas

In Arkansas, going electric comes with a yearly bill. EV owners pay an additional $200 in registration fees, while plug-in hybrids pay $100. The state doesn’t offer much in the way of credits either, so driving electric here feels like paying road costs rather than saving money.

California

California is the overachiever. You’ll pay an extra annual EV fee of $118, but the state throws back plenty of perks: rebates, incentives, and carpool lane privileges if you qualify. It’s a love-hate deal, but California wants you to drive electric even if it costs you up front.

Colorado

Colorado makes EV life pretty sweet. Drivers pay about $60.05 a year in extra registration fees, which is chump change compared to some states. Colorado also gives $3,500 in tax credits for new EV purchases, making it one of the friendlier states to go green on the road.

Connecticut

Connecticut has no EV fee, but you get solid rebates through the CHEAPR program. You can get up to $5,000 in tax credit for buying an EV. Drivers can also skip penalties and get serious purchase perks, so the Nutmeg State is a nice place to plug in and save.

Delaware

Delaware keeps EV ownership simple with no extra registration fees and offers rebates for new EV purchases through the state’s Clean Vehicle Rebate Program. It’s a win-win: you don’t get dinged for owning an electric, and you can get some cash when you buy one.

District of Columbia

DC doesn't have a purchase tax credit for EVs, but they have a few solid perks. Brand-new battery electric vehicles only pay $36 each year for registration for the first two years. After that, owners will pay normal rates based on weight class.

Florida

Florida is hands-off with EVs. No special tax credits, no extra registration fees, nothing. It’s one of the few states where going electric doesn’t cost more, but doesn’t save more either. EV drivers here just get federal perks and lower fuel costs.

Georgia

Georgia used to offer EV tax credits as if it were nothing, but that's all in the past now. Drivers are subjected to an annual registration fee of a whopping $234.97 for an EV. There aren't any legitimate rebates to make it any better, so owning an EV here feels like paying up more than cashing in.

Hawaii

EV owners in Hawaii pay $50 a year for registration and do not receive any tax credits for the purchases. However, with lower fuel costs and some utility benefits, going electric while living in paradise still seems like a cost-effective way to live the aloha lifestyle.

Idaho

Idaho EV owners pay around $140 a year, and plug-in hybrid owners pay $75. While there are zero purchase credits, the lower operating costs and local incentives help soften the blow. It’s a state where driving electric feels doable as long as you remember to budget that extra registration tag.

Illinois

Illinois is trying to make EVs cool. Owners pay a small extra registration fee, and the state offers $4,000 in tax credits for new EV purchases. That makes it easier to justify the switch to electric in the Land of Lincoln.

Indiana

Indiana adds a $230 annual fee for EVs and $77 for plug-in hybrids. There are no major state purchase credits, so most of the benefit comes from skipping gas stations and federal incentives.

Iowa

Iowa keeps it simple. Drivers pay an extra $130 a year for EV registration and $65 for plug-in hybrids. The state does not offer tax credits, but lower fuel bills and federal incentives still make going electric a worthwhile option.

Kansas

Kansas drivers with EVs pay an extra $165 a year for registration, and hybrids pay $70. But the state offers up to $4,000 in purchase tax credits. That makes the extra registration cost easier to swallow, and keeps Kansas surprisingly EV-friendly.

Kentucky

Kentucky makes EV ownership a bit more expensive. Drivers pay $120 a year for EVs and $60 for hybrids. Since there are big tax breaks to sweeten the deal, owning electric here isn’t about the incentives; it’s about skipping gas stations and hoping your battery can handle those rolling Bluegrass hills.

Louisiana

In Louisiana, EV owners pay about $110 extra a year, and hybrids pay $60. There are no big state credits on the table, so most drivers lean on federal perks. The upside is that fewer trips to the pump mean more time for crawfish boils instead of waiting in gas station lines.

Maine

Maine actually encourages you to plug in. EVs have no extra registration fee, and you get about $7,500 in tax credits. Between clean air and coastal drives, Maine is one of the friendlier states for going electric.

Maryland

Maryland mixes fees with some good stuff. EV registration fees are $125 a year, and hybrids are $100. But the state offsets that with some nice rebates for new EV purchases and charging equipment. If you’re looking to make the switch, Maryland helps balance the books so it doesn’t feel like a penalty.

Massachusetts

Massachusetts is one of the friendlier states for EV buyers. You can get up to $3,500 in purchase tax credit, and here’s the kicker: no extra annual registration fee for owning an EV. That’s rare and makes going electric not feel so painful on the wallet.

Michigan

For the home of the auto industry, Michigan’s EV perks are pretty weak. It offers no purchase tax credit and a $160 annual fee for EVs and $60 for hybrids. You’re basically paying extra every year just to drive the cars Michigan automakers brag about.

Minnesota

Minnesota keeps it simple with EVs. No purchase tax credit, but you’ll owe $75 a year if you own a fully electric car. Hybrids? Zero fees. So if you’re on the fence, hybrids look a lot friendlier on your budget.

Mississippi

Mississippi isn’t giving out EV tax credits, but you’ll get a bill for $150 a year for EVs and $75 for hybrids. That’s basically a “thanks for going green, now pay up” situation. For a state still building out its charging network, it feels like a mixed message.

Missouri

In Missouri, you get no purchase tax credit but extra fees. EVs cost $135 per year, and hybrids cost $67.50. It’s not the worst, but it’s not a high-five for going electric. At least the charging scene is getting better.

Montana

Montana doesn’t give out EV tax credits, but it sure knows how to add fees. EV owners pay $130 to $190 a year, while hybrid owners pay $70 to $100. For a state with endless roads, that extra annual bill is a bumpy ride for green drivers.

Nebraska

Nebraska doesn’t do tax credits and goes straight to the fee lane. EV owners pay $150 a year, hybrid owners pay $75. For those looking to save in the long term, that bill just keeps adding up.

Nevada

Nevada doesn’t have an EV purchase tax credit, but it has no registration fees either. So while you won’t get big upfront savings, you won’t get extra yearly charges. In a state where road trips are a way of life, that’s a pretty good deal.

New Hampshire

New Hampshire has no EV purchase tax credit, but has an annual fee of $100 for EVs and $50 for hybrids. It may not be the worst, but it’s definitely a reminder that driving electric here comes with a little extra paperwork for your wallet every year.

New Jersey

New Jersey is a mixed bag for EV drivers. On the plus side, the state offers up to $4,000 in purchase tax credits, which is huge. On the downside, EV owners pay a big $260 yearly fee. Hybrids though? They get off scot free.

New Mexico

New Mexico keeps it simple and driver-friendly: up to $3,000 in EV purchase tax credits and zero annual registration fees. That’s a nice chunk of change to take off the sticker price. If you’re driving Route 66 in an EV, at least the paperwork won’t slow you down.

New York

In New York, EV drivers are eligible for as much as $2,000 in purchase tax credits and do not pay an annual registration fee. Between that and state incentives for charging stations, it feels like New York is saying, “Yeah, we’d like fewer exhaust fumes in the air, thanks”.

North Carolina

North Carolina isn’t exactly rolling out the red carpet for EVs. There is no purchase tax credit for EV owners for buying an electric vehicle, and the annual registration fees are high; EV owners pay $214.50, while drivers of hybrid vehicles pay $107.25.

North Dakota

While North Dakota does not have any EV purchase incentives, it does have annual fees: $120 for EVs and $50 for hybrids. It's not the most expensive setup, but it is just enough to make you double-check whether those open roads will actually be cheaper.

Ohio

Ohio is hard on EV and hybrid drivers. There are no tax credits, and the annual registration fee is $200 for EVs and $150 for hybrids. So whether you go full electric or dip your toe in with a hybrid, you’ll feel the pinch every year.

Oklahoma

Oklahoma is unexpectedly EV-friendly. It offers up to $5,500 in purchase tax credits for drivers. But here’s the catch: registered vehicles also have annual registration fees of $110 for EVs and $82 for hybrids. So you save money up front, but pay every year.

Oregon

Oregon has a great love for being green, and it shows that appreciation with a $7,500 tax credit for EV buyers. EV owners pay $115 a year for the vehicle registration fees, while hybrid owners pay $35, which is still a nice trade-off.

Pennsylvania

Pennsylvania has a decent balance. You can receive up to $3,000 in tax credits from the state for purchasing an EV, which is a nice benefit. However, the state charges $200 a year for your EV and $50 for hybrids.

Rhode Island

Rhode Island offers up to $1,500 in EV tax credits. Although that’s relatively smaller, it’s still money back in your pocket. On the flip side, expect to pay $200 a year for EV registration and $150 if you drive a hybrid.

South Carolina

Since there are no tax credits in South Carolina, you will get no immediate breaks here. However, the fees are minimal: $60 a year for EVs and $30 for hybrids. It's not flashy, but if you appreciate low costs and an uncomplicated framework, South Carolina will feel refreshingly simple.

South Dakota

South Dakota is very straightforward: there is no tax credit for the purchase of an electric vehicle. On the plus side, the annual registration fee for EVs is $50, and hybrids are free.

Tennessee

While Tennessee does not provide tax credits to EV buyers, it ensures that you aid in covering road expenses. It’s $200 a year for EVs and $100 for hybrids. It’s their way of saying, “Welcome to the road, but don’t forget your share.”

Texas

While Texas does not offer tax credits for buying electric vehicles, it certainly makes sure that electric drivers contribute to its famous roads. Electric vehicle owners pay a flat $200 annual registration fee, while hybrid vehicles don’t pay anything additional. This is strictly Texas-style toughness.

Utah

Utah does not offer EV tax credits, and car owners pay $130.25 per year for EVs and $56.50 for hybrids. The fees are oddly precise, but that’s just Utah being structured, balanced, and clear about its expectations from drivers plugging in or mixing gas with electricity.

Vermont

Vermont really loves EV buyers, offering up to $5,000 in tax credits. It’s one of the better deals out there. Car owners pay $89 a year for EVs and $44.50 for hybrids. With that upfront savings, most aren’t complaining too much.

Virginia

In Virginia, EV owners can benefit from tax credits worth up to $2,500. But then, the state hits them with an oddly specific $131.88 annual registration fee for EVs while hybrids have no fee at all.

Washington

Although Washington does not provide tax credits for purchasing an EV, it does ensure that road costs are shared. EV drivers are billed $150 annually, while hybrids are billed $75. It’s not overly generous, but it’s certainly easy to understand.

West Virginia

West Virginia is tougher on EVs, offering no purchase tax credit and steep annual registration fees. Owners of EVs are mandated to pay $200 annually, while owners of hybrids pay $100. If you were hoping for any kind of encouragement to pick a greener car, you're not getting any gold stars in this state anytime soon.

Wisconsin

Wisconsin keeps it simple, but not particularly rewarding. The fees for EVs and hybrids are $175 and $75, respectively, and there is no tax credit for purchasing an EV. It is not the most expensive, but it's not generous, either.

Wyoming

Wyoming does not provide any tax credits for EV buyers, favoring a no-frills fee structure instead. Those who drive fully electric cars pay $200 every year, but hybrids get off free. It’s simple, but also a bit discouraging for anyone hoping the Cowboy State would throw EV owners a bone.