Highest Gas Tax States in America

If you ever feel like filling up your tank drains your wallet faster than it should, you're not alone. Some states hit drivers harder than others with sky-high gas taxes. Let’s break down the 11 worst offenders. Who knows, your state might be on the list.

Indiana: 56.1 Cents per Gallon

Indiana drivers feel the sting at the pump with gas taxes hitting 56.1 cents per gallon. This cost includes a base excise tax and a sales tax tied to the gas price, which makes it even harder to budget. To save, Hoosiers gas up at Costco or shop fuel rewards.

Oregon: 40 Cents per Gallon

Oregon’s gas tax is at 40 cents a gallon. It’s how the state pays for road maintenance, bridges, and transportation projects. Since there’s no sales tax in Oregon, fuel taxes help make up for the shortfall. Some drivers join programs like OReGO to avoid the brunt.

Maryland: 46.10 Cents per Gallon

Maryland’s gas tax is over 46 cents per gallon. It keeps creeping up thanks to automatic annual adjustments based on inflation. The money funds everything from fixing potholes to public transport. Locals hunt for cheaper prices in nearby Delaware where taxes are lower.

California: 70 Cents per Gallon

Californians pay a whopping 70 cents per gallon in gas tax. The state adds extra costs for environmental fees and climate programs Some of the money goes towards road repairs and clean energy initiatives. Unsurprisingly, many Californians have switched to hybrids and EVs to escape the pinch on their purses.

North Carolina: 40.65 Cents per Gallon

North Carolina’s gas tax is just over 40 cents a gallon. And it adjusts with inflation and fuel consumption rates. To save a little, drivers stick to discount stations or time their fill-ups during weekly dips in gas prices. Anything for a little respite, right?

Ohio: 38.5 Cents per Gallon

Ohioans pay 38.5 cents per gallon in state gas taxes. Back in 2019, the state saw a big jump in taxes, with the money used to help maintain aging roads and bridges. It’s still cheaper than many of its neighboring states where the gas tax prices are higher.

Washington: 52.82 Cents per Gallon

Washington state drivers fork out nearly 53 cents in gas taxes every time they fill up. It’s one of the higher rates. The state bumped it up recently. To cut costs. Many use rewards programs, fill up across the Oregon border, or choose more fuel-efficient cars.

Pennsylvania: 58.7 Cents per Gallon

Pennsylvania used to have the highest gas tax in the country. A lot of the money generated from the 58.7 cents per gallon gas tax goes toward fixing crumbling roads. Understandably, locals complain about the high prices and look for smaller, rural stations to fill up.

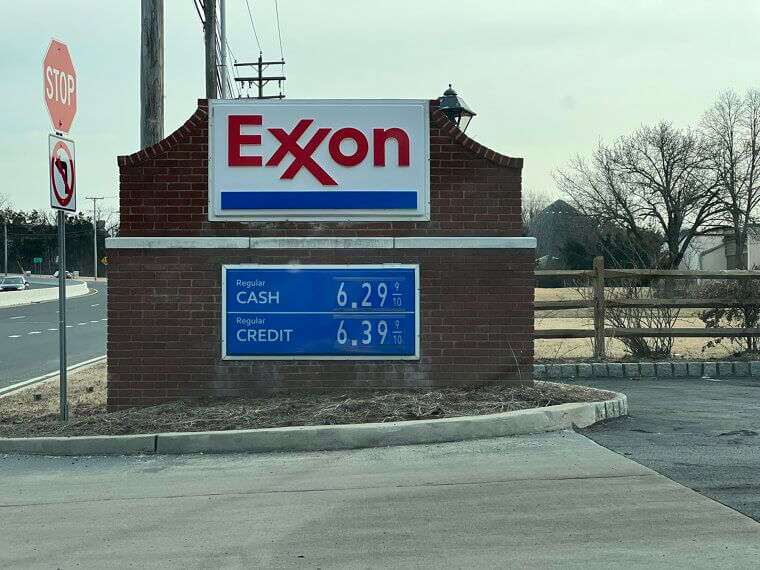

New Jersey: 44.9 Cents per Gallon

New Jersey might have one of the lower gas tax rates on our list, but drivers still feel they’re paying too much. People here love their loyalty cards, fill up at discount stations near big box stores, and use full-service pumps to make the most of their buck.

Illinois: 67.1 Cents per Gallon

Illinois hits drivers hard with a gas tax of 67.1 cents per gallon. Yes, you read that right… 67.1 cents. The state doubled the rate in 2019, and it keeps increasing with inflation. Add in local taxes in places like Chicago, and you’ll realize things get pricey fast.

Michigan: 48 Cents per Gallon

Michigan's state gas taxes help maintain roads. At 48 cents per gallon, it’s not the highest rate we’ve seen, but it can be a burden on already-stretched budgets. People save where they can by using loyalty programs or fueling up at tribal stations with lower rates.